By most measures, investors have reason to be skeptical about vaccine specialist Novavax (NASDAQ:NVAX). Once heralded as a key player in the race to find a solution for the COVID-19 disaster, Novavax shares collapsed as fears of the virus faded sharply. Since then, the company has struggled for relevance. While very few experts will see the biotechnology firm as a robust investment opportunity, too much bad news could fuel a shocking reversal. Therefore, I am near-term bullish on NVAX stock.

Skepticism Reigns Supreme for NVAX Stock

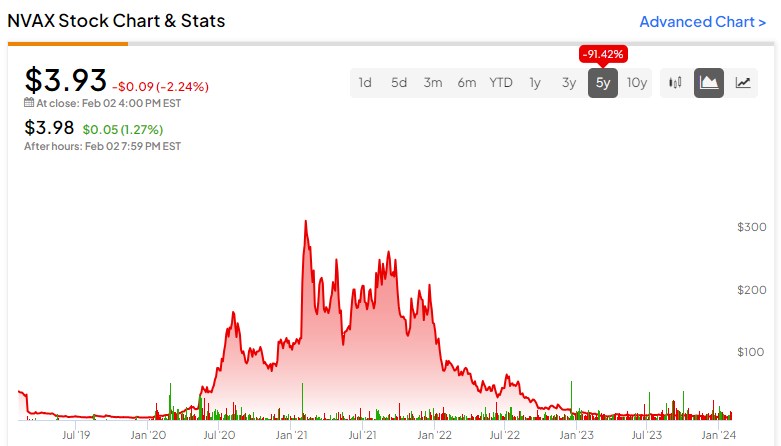

Before diving into the factors that could spark a rally that few believe possible, it’s important to acknowledge the deep-seated troubles Novavax faces. For example, even with the promise of a new year, NVAX stock fell by a staggering 20% since the beginning of January. And just to reinforce the point, in the past 52 weeks, NVAX had shed about 66% of its equity value.

If stakeholders were hoping for an auspicious start, this wasn’t it. Further, management itself isn’t giving off encouraging signals. As the TipRanks Newsdesk pointed out recently, Novavax announced a strategic plan to reduce its annual spending. That’s the fancy way of saying it will lay off its global workforce. Unfortunately, the job cuts will impact approximately 12% of the firm’s full-time employees and contractors.

Moreover, it wasn’t the first time Novavax resorted to a headcount reduction. In May 2023, management made the decision to cut 25% of its workforce. While the move should theoretically help streamline its financials, the main issue has always been scientific relevancy.

According to The New York Times, Novavax was on the verge of collapse a year before the COVID-19 crisis. “One of its leading vaccine candidates — to prevent a deadly virus in infants — had failed for the second time in three years. The company’s stock was trading so low that it risked being removed from the Nasdaq,” the NYT wrote.

Then, the pandemic gave NVAX stock a second lease on life. Certainly, it made the most of its opportunity. On a weekly average basis, NVAX briefly breached the $290 level. However, since December 2021, Novavax has been struggling to gain traction.

Essentially, the company is almost back to where it once was. With the COVID catalyst all but gone, management must convince its remaining shareholders to hold true. That’s a gargantuan task. However, NVAX stock may still get its lifeline.

Why Betting Against Novavax Is a Bad Idea

Given the terrible print, traders may be tempted to bet against NVAX stock. That might be a bad idea. Like a sports wager, if the bookie sweetens the pot with line adjustments that increasingly favor the underdog, at some point, betting on the favorite could be a risky venture. And that may be the case with Novavax.

Unsurprisingly, an options flow screener – which exclusively filters for big block transactions likely made by institutions – shows heavy volume of short (sold) calls. Basically, these are bets that the underlying security will not rise above a specified strike price. In particular, on January 16, a trader (or traders) sold 7,355 contracts of the NVAX Apr 19 ’24 5.00 Call.

Additionally, it’s a high-conviction trade. For underwriting the risk, the call sellers received a premium of $371,000. However, at the money, the baseline totality of this trade is worth about $3.68 million (7,355 contracts multiplied by 100 shares per contract multiplied by the $5 strike). And the underlying liability is uncapped because NVAX stock could theoretically rise indefinitely.

Now, many, if not most, traders likely believe that Novavax won’t rise materially higher; hence, the high short call volume. Still, because so many traders are standing on one side, the gamma exposure for the option arena’s market makers stands at $140,000 for every 1% stock move. In a bid to be “delta neutral,” the market maker would be forced to take opposite wagers should NVAX stock move unexpectedly.

To quickly explain, in options trading, gamma exposure measures the rate of change in an option’s delta concerning the underlying stock’s price movement. To hedge against risk and maintain delta neutrality, market makers may need to adjust their options positions by taking counteractive measures.

Such an unexpected move could very well occur because NVAX simultaneously runs an extremely high short interest of 48.24% of its float. Also, the short-interest ratio stands at 9.44 days to cover, requiring about two trading weeks for the bears to fully unwind their short position based on average trading volume.

If NVAX stock swings higher for whatever reason, it could panic the shorts in the open market, which could easily cascade into panic in the options market as the sold calls get blown up.

A Longer-Term Investment? No.

While it’s critical to stress that NVAX stock could catch unsuspecting prospective bears off guard, such a framework centers on the nearer-term narrative. Should investors consider Novavax as a longer-term buy? In my view, no. It’s just too risky.

Perhaps most glaringly, the company posted revenue of just under $187 million in the third quarter of Fiscal 2023. In sharp contrast, Novavax generated sales of $628.3 million in the year-ago period. Adding to the misery, without a clear product candidate, the biotech’s future is very much in question.

Is NVAX Stock a Buy, According to Analysts?

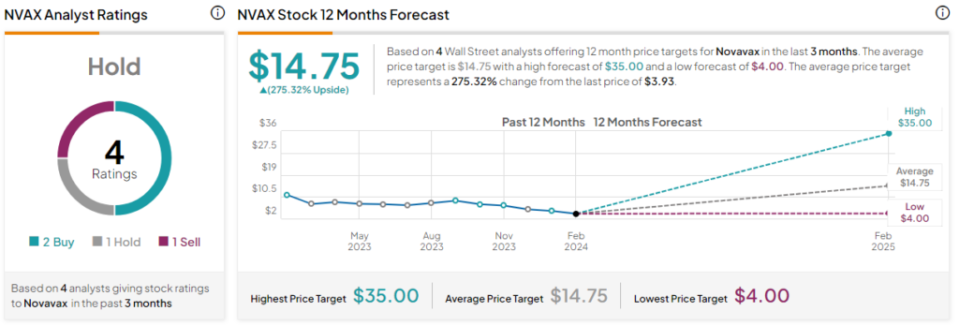

Turning to Wall Street, NVAX stock has a Hold consensus rating based on two Buys, one Hold, and one Sell rating. The average NVAX stock price target is $14.75, implying 275.3% upside potential.

The Takeaway: NVAX Stock Offers a Temporary Opportunity

Embattled Novavax could see a short-term rally due to heavy bearish bets. Despite facing significant challenges, including declining revenue and workforce reductions, the high short interest and concentrated short call positions leave NVAX stock vulnerable to a potential squeeze if the share price unexpectedly rises. However, this is not considered a long-term investment opportunity due to the company’s uncertain future and lack of a clear product candidate.

Disclosure

Source link