Jupiter’s ‘tormented moon’ Io just unleashed the most powerful volcanic event ever seen

A NASA spacecraft orbiting Jupiter has just witnessed some of the most extreme volcanic eruptions ever seen in the solar system, coming from a giant underground magma chamber on the “tormented” Jovian moon Io. The energy pouring from this record-breaking hot spot far exceeds the amount of power we are producing on Earth, researchers say.

Io is Jupiter’s third-largest moon, spanning roughly 2,300 miles (3,700 kilometers) across, which makes it slightly bigger than Earth’s moon. It orbits Jupiter at a distance of around 262,000 miles (422,000 km) — also similar to how far away the moon orbits Earth — but it travels much faster than its lunar counterpart, whipping around Jupiter every 42.5 hours. This is due to the gas giant’s immense gravity, which has also turned Io into a fiery hellscape covered with up to 400 volcanoes and multiple lava lakes.

Io is frequently monitored by NASA’s Juno spacecraft, which has been circling Jupiter in a highly elliptical, or stretched, orbit since 2016. Juno passes by Io once every few months and fixes its gaze on the volcanic satellite so scientists can learn more about the moon’s fiery insides.

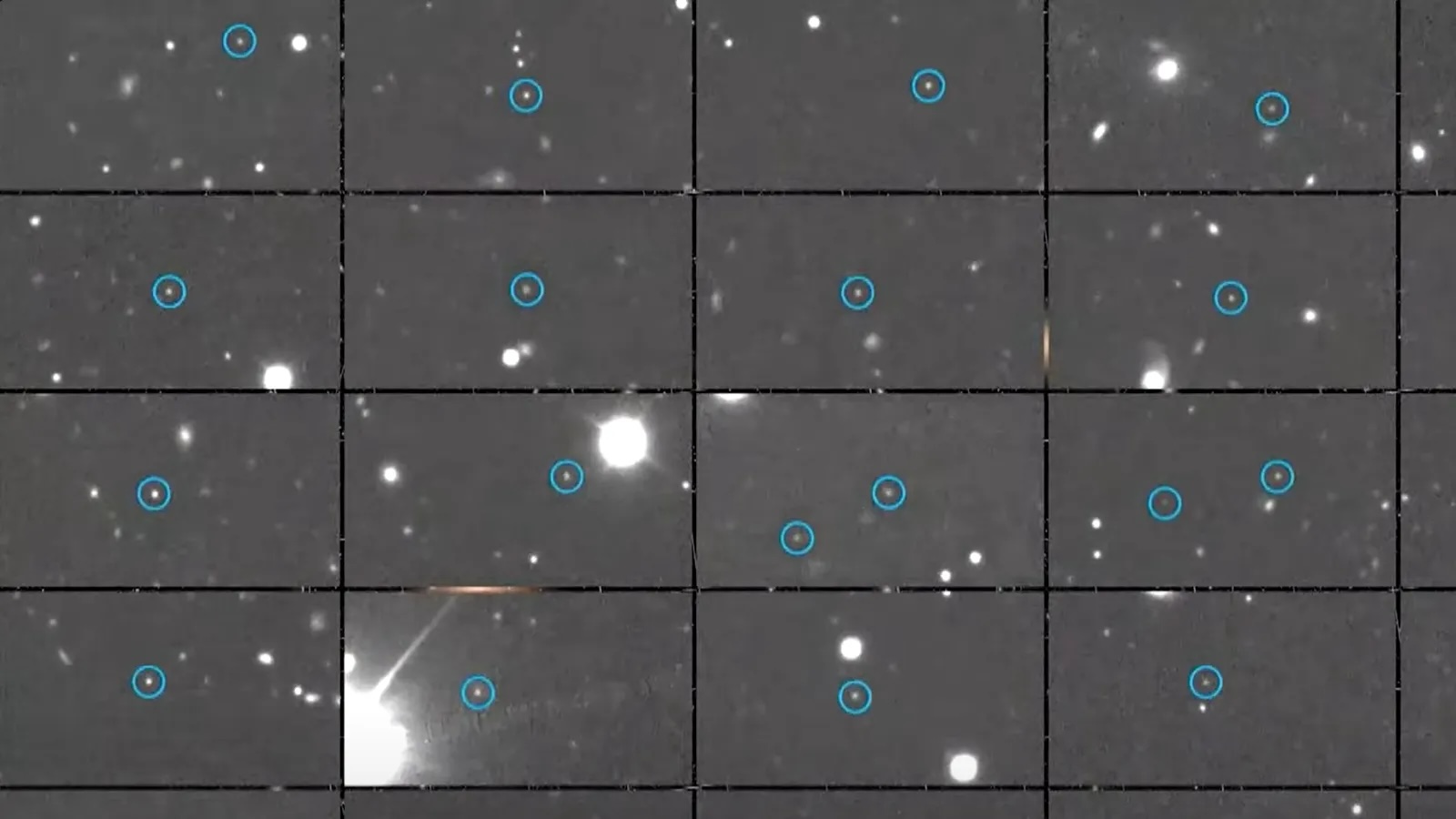

During Juno’s latest flyby of Io, on Dec. 27, 2024, the spacecraft’s Jovian Infrared Auroral Mapper (JIRAM) instrument detected a massive new infrared hot spot in the moon’s southern hemisphere where multiple eruptions, likely fueled by a single giant magma chamber, were taking place, NASA representatives wrote in a statement.

The giant hot spot was chucking out around 80 trillion watts of energy, which is equivalent to “six times the total energy [output] of all the world’s power plants,” according to NASA.

Related: Space photo of the week: An eerie look at Io, the most volcanic world in the solar system

“The data from this latest flyby really blew our minds,” Scott Bolton, a space physicist at the Southwest Research Institute in San Antonio and principal investigator of the Juno mission, said in the statement. “This is the most powerful volcanic event ever recorded on the most volcanic world in our solar system — so that’s really saying something.”

Juno also captured photographs of Io, which revealed that a large dark patch has emerged on the moon’s surface. This area is likely covered in solidified lava flows that poured out during the eruption, according to NASA. However, the spacecraft was too far away during the recent flyby to capture detailed images of the dark spot, so its true nature remains unclear.

Based on the size of the mysterious surface feature and the levels of thermal radiation, researchers estimated that the magma chamber that feeds this hot spot likely spans an area of around 40,000 square miles (105,000 square kilometers) — around 30% larger than Lake Superior, Earth’s largest freshwater lake. This makes the chamber the largest volcanic feature on Io, surpassing Loki Patera — a giant lake of lava covering an area of around 8,000 square miles (21,000 square km) in Io’s northern hemisphere.

Extreme volcanism

Io’s intense volcanic activity is the result of “tidal flexing,” where the moon is continuously being squeezed and released like a stress ball by Jupiter’s crushing gravity. This external force superheats the rock beneath Io’s surface, transforming it into magma that then erupts onto the surface.

This is different from volcanic activity on Earth, which is driven by internal heating from our planet’s molten metal core.

For decades, researchers speculated that the entire subsurface of Io was one big magma ocean. However, last year, researchers conclusively demonstrated that this was not the case. Instead, only specific areas, like the newly discovered magma chamber, accumulate concentrations of magma beneath each of the moon’s visible volcanic features.

Juno will perform a closer flyby of Io on March 3, which should give researchers a better idea of what is happening inside the newly discovered magma chamber and provide clues about volcanism elsewhere in the solar system.

“While it is always great to witness events that rewrite the record books, this new hot spot can potentially do much more,” Bolton said. “The intriguing feature could improve our understanding of volcanism not only on Io but on other worlds as well.”

Source link