Ancient Egypt: History, dynasties, religion and writing

Ancient Egypt in North Africa was one of the most powerful and influential civilizations in the region for over 3,000 years, from around 3100 B.C to 30 B.C. It left behind numerous monuments, documents and works of art that continue to be studied by scholars today.

However Egyptian civilization existed long before this period, and it has survived and flourished since. While the civilization’s rulers, language, writing, climate, religion and borders have changed many times over the millennia, Egypt still exists as a modern-day country.

Ancient Egypt was closely connected with other parts of the world, bringing in and exporting goods, religions, food, people and ideas. At times ancient Egypt ruled territory outside the modern-day country’s border, controlling territory in what is now Sudan, Cyprus, Lebanon, Syria, Israel and Palestine.

The country was also occupied by other powers in ancient times — the Persians, Nubians, Greeks and Romans all conquered Egypt at different points.

A number of names were used for Egypt. A popular ancient name for Egypt was “Kemet,” which means the “black land.” Scholars generally believe that this name derived from the fertile soil that was left over when the Nile flood receded in August.

The Nile flooded between June and August each year, and the fertile soil it created was vital to ancient Egypt’s survival, with fertility playing an important role in Egyptian religion. The burial of Tutankhamun — in which his penis was mummified — is but one example of how important fertility was in the rituals and beliefs of the ancient Egyptians.

The country’s ancient rulers are referred to today as “pharaohs,” although in ancient times they each used a series of names as part of a royal titular, wrote Ronald Leprohon, a professor emeritus of Egyptology at the University of Toronto, in his book “The Great Name: Ancient Egyptian Royal Titulary” (Society of Biblical Literature, 2013). The word pharaoh originates from the Egyptian term “per-aa,” which means “the Great House,” Leprohon wrote. The term was first incorporated into a royal title during the rule of Thutmose III (reign circa. 1479 to 1425 B.C.), Leprohon wrote.

Egypt’s prehistory

When exactly early hominids first arrived in Egypt is unclear. The earliest migration of hominids out of Africa took place almost 2 million years ago, with modern humans dispersing out of Africa about 100,000 years ago. Egypt may have been used to reach Asia in some of these migrations.

Villages dependent on agriculture began to appear in Egypt about 7,000 years ago. The civilization’s earliest written inscriptions date back about 5,200 years and reveal information about the early rulers of Egypt. These early rulers include Iry-Hor, who, according to the inscriptions, founded Memphis, a city that served as Egypt’s capital for much of its history. The inscriptions also document a queen named Neith-Hotep, who ruled as a regent for a young pharaoh named Djer sometime In the late predynastic period.

Related: How old is ancient Egypt?

How and when ancient Egypt was united into one kingdom is a matter of debate among archaeologists and historians. One possibility is that a number of smaller states coalesced into two kingdoms — Upper and Lower Egypt — and then these two kingdoms united. After Egypt was united pharaohs were often depicted wearing two crowns — one for Lower Egypt and another for Upper Egypt.

Egypt’s climate was much wetter in prehistoric times than it is today, and some areas that are now barren desert were once fertile. One famous archaeological site where this can be seen is at the 6,000- to 9,000-year-old rock art at the “cave of swimmers,” as it is called today, on the Gilf Kebir plateau in southwest Egypt. The cave is now surrounded by miles of barren desert; however, it has rock art showing what some scholars interpret as people swimming. After this wet period ended around 5,000 years ago, the deserts of Egypt have remained pretty similar to how they are now, Joseph Manning, the William K. and Marilyn Milton Simpson professor of classics at Yale University, previously told Live Science.

Egypt’s dynasties and pharaohs

Ancient Egypt’s history has traditionally been divided into 30 (or sometimes 31) dynasties. However, “the ‘dynasties’ of Egypt are really just retrospective constructs,” Michael Dee, an associate professor of isotope chronology at the University of Groningen in the Netherlands, previously told Live Science in an email.

The Egyptian priest Manetho, who lived during the third century B.C., started the dynasty construct. His accounts of ancient Egyptian history were preserved by ancient Greek writers and, until hieroglyphic writing was deciphered in the 19th century, were among the few historical accounts that scholars could read.

Modern-day scholars often group these dynasties into several periods. Dynasties one and two date back around 5,000 years and are often called the “Early Dynastic” or “Archaic” period. The first pharaoh of the first dynasty was a ruler named Menes (or Narmer, as he is called in Greek). He lived over 5,000 years ago, and while ancient writers sometimes credited him as being the first pharaoh of a united Egypt, however archaeological research suggests that this is not true. Recently found inscriptions tell of rulers — such as Djer and Iry-Hor — who appear to have ruled earlier and other finds have been made which suggest that there were pharaohs before Menes who ruled a united Egypt. Scholars sometimes refer to these pre-Menes rulers as being part of a “dynasty zero.”

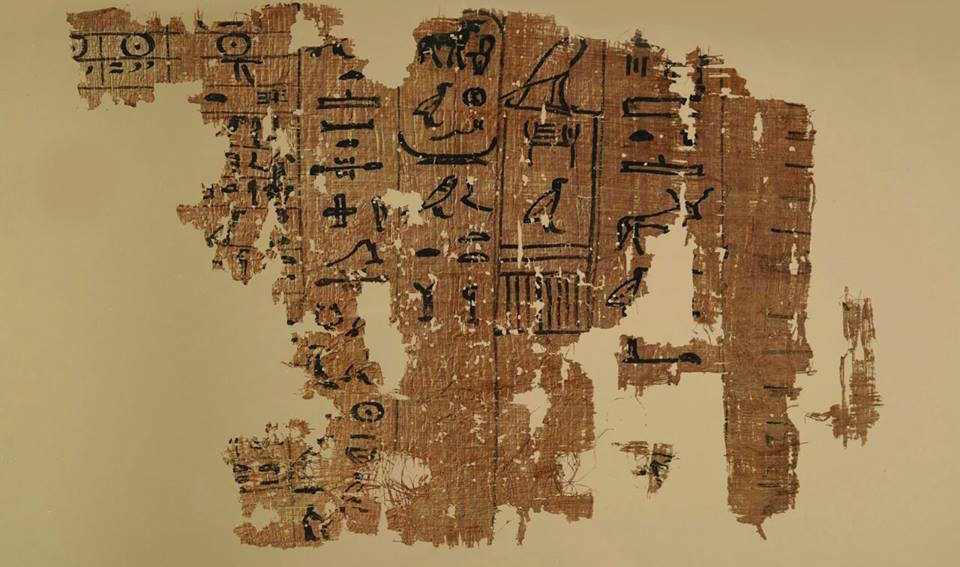

Dynasties three to six date from roughly 2650 to 2150 B.C. and are often grouped together into a time period called the “Old Kingdom” by modern-day scholars. During this time pyramid-building techniques were developed and the pyramids of Giza were built. Papyri that are still being deciphered suggest that groups of professional workers — sometimes translated as “work gangs” — played a major role in the construction of the pyramids, as well as other structures.

From 2150 to 2030 B.C. (a time period that encompassed dynasties seven to 10 and part of 11) the central government in Egypt was weak and the country was often controlled by different regional leaders. Why the Old Kingdom collapsed is a matter of debate among scholars, with research indicating that drought and climate change played a significant role. During this time, cities and civilizations in the Middle East also collapsed, with evidence at archaeological sites indicating that a period of drought and arid climate hit sites across the region.

The 12th, 13th and part of the 11th dynasties are often called the “Middle Kingdom” by scholars and lasted from around 2030 to 1640 B.C. At the start of this dynasty, a ruler named Mentuhotep II (who reigned until about 2000 B.C.) regained control of the whole country. Pyramid building resumed in Egypt, and a sizable number of texts of literature and science were created. Among the surviving texts is a document now known as the Edwin Smith surgical papyrus, which records a variety of medical treatments that modern-day medical doctors have hailed as being advanced for their time.

Dynasties 14 to 17 are often grouped together as the “Second Intermediate Period” by modern-day scholars. During this time, the central government again collapsed in Egypt, and a group called the “Hyksos” rose to power, controlling much of northern Egypt. While the Hyksos may have originally been from the Levant (an area that encompasses modern-day Israel, Palestine, Lebanon, Jordan and Syria), research indicates that they were already in Egypt at the time the government collapsed. One gruesome find from this time period is a series of severed hands, which were found at a palace at the city of Avaris, the capital of Hyksos-controlled Egypt. The severed hands may have been presented by soldiers to a ruler in exchange for gold.

Scholars often refer to dynasties 18 to 20 as encompassing the “New Kingdom,” a period that lasted around 1550 to 1070 B.C. This period took place after the Hyksos had been defeated by a series of Egyptian rulers and the country reunited. Perhaps the most famous archaeological site from the New Kingdom is the Valley of the Kings, which holds the burial sites of many Egyptian rulers from this period, including Tutankhamun (reign circa 1336 to 1327 B.C.), whose rich tomb was found intact in1922. The pharaohs stopped building pyramids during the New Kingdom for a variety of reasons — one of which was to provide better security against tomb robbers.

The 21st to 24th dynasties (a period from around 1070 to 713 B.C.) are often called the “Third Intermediate Period” by modern-day scholars. The central government was sometimes weak during this time period, and the country was not always united. During this time cities and civilizations across the Middle East had been destroyed by people from the Aegean, whom modern-day scholars sometimes call the “Sea Peoples.” While Egyptian rulers claimed to have defeated the Sea Peoples in battle, it didn’t prevent Egyptian civilization from collapsing. The loss of trade routes and revenue may have played a role in the weakening of Egypt’s central government.

Dynasties 25 to 31 (from around 712 to 332 B.C.) are often referred to as the “Late Period” by scholars. Egypt was sometimes under the control of foreign powers during this time. The rulers of the 25th dynasty were from Nubia, an area located in modern-day southern Egypt and northern Sudan. The Persians and Assyrians also controlled Egypt at different times during the Late Period.

In 332 B.C. Alexander the Great drove the Persians out of Egypt and incorporated the country into the Macedonian Empire. After Alexander the Great’s death, a line of rulers descended from Ptolemy Soter, one of Alexander’s generals, came to power. The last of these “Ptolemaic” rulers (as scholars often call them) was Cleopatra VII, who died by suicide in 30 B.C after the defeat of her forces by Octavian, who would later be named the Roman emperor Augustus, at the Battle of Actium. After her death, Egypt was incorporated into the Roman Empire.

Although the Roman emperors were based in Rome, the Egyptians treated them as pharaohs. One excavated carving shows the emperor Claudius (reign A.D. 41 to 54) dressed as a pharaoh, Live Science reported. The carving has hieroglyphic inscriptions saying that Claudius is the “Son of Ra, Lord of the Crowns,” and “King of Upper and Lower Egypt, Lord of the Two Lands.”

Neither the Ptolemaic or Roman rulers are considered to be part of a numbered dynasty.

Ancient Egyptian Religion and Gods

Throughout much of Egypt’s ancient history its people followed a polytheistic religion in which a vast number of gods and goddesses were venerated. One of the most important was Osiris, god of the underworld. Abydos was an important cult center for him, and numerous temples and shrines were constructed at the site in his honor.

Amun-Ra — a god associated with the sun — became particularly important during the New Kingdom and was associated with the city of Luxor (ancient Thebes). The Karnak Temple complex was built near Luxor in honor of this god.

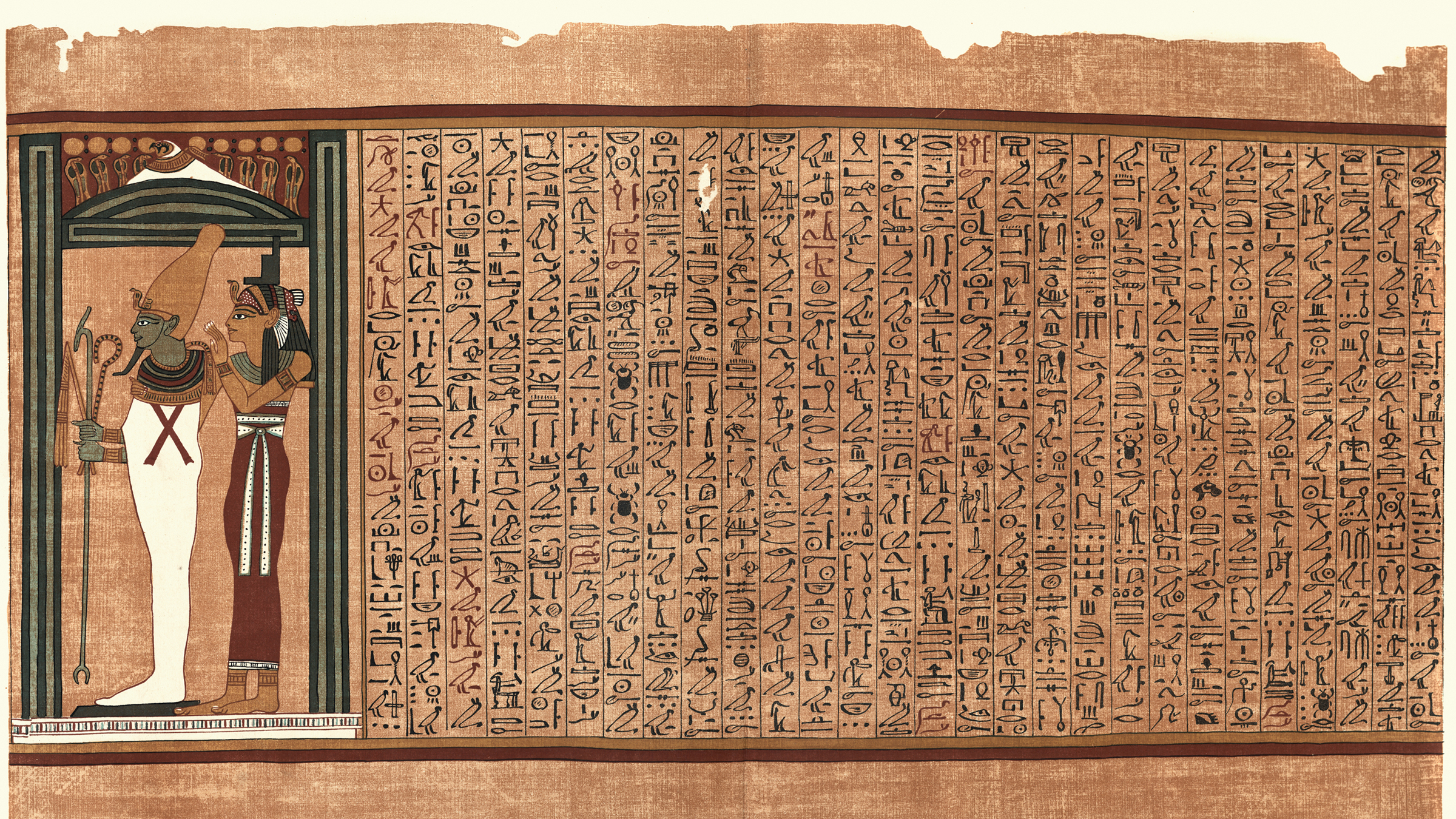

Navigating the underworld was vital to the ancient Egyptians, who believed that the dead could reach a paradise of sorts, where they could live forever. Egyptian dead were sometimes mummified, preserving the body, and were sometimes buried with spells to aid them in navigating the underworld. These spells included excerpts from what are sometimes called the “Book of the Dead” — a 52-foot-long (16 meters) copy of which was recently found in a tomb at Saqqara.

In ancient Egyptian mythology, one of the first steps in navigating the underworld was to weigh a person’s deeds against the feather of Maat, who was a god associated with truth, justice and order. If the person had committed a great deal of wrong, the person’s heart would be heavier than the feather and the person’s soul would be obliterated. On the other hand, if their deeds were generally good, they passed forward and had the opportunity to successfully navigate the underworld.

Figurines called shabti were often buried with the deceased. Their purpose was to do the deceased’s work in the afterlife for them.

Egyptian religion did not remain static but changed over time. One major change occurred during the reign of the pharaoh Akhenaten (circa 1353 to 1335 B.C.), a ruler who unleashed a religious revolution that saw Egyptian religion become focused around the worship of “Aten” the sun disk. Akhenaten built an entirely new capital in the desert at Amarna and ordered the names of some of Egypt’s deities to be defaced. After Akhenaten’s death his son, Tutankhamun, denounced him and returned ancient Egypt to its previous polytheistic religion.

When Egypt came under Greek and Roman rule, the new rulers’ gods and goddesses were incorporated into Egyptian religion. Another major change occurred after the first century A.D. when Christianity spread throughout Egypt. At this time Gnosticism, a religion that incorporated some Christian beliefs, also spread throughout Egypt, and a large corpus of Gnostic texts were discovered in 1945 in southern Egypt near the city of Nag Hammadi.

Islam spread throughout the country after A.D. 641, when the country was captured by a Muslim army. Today, Islam is practiced by the majority of Egypt’s inhabitants, while a minority are Christian, many being part of the Coptic Church.

Egyptian writing

The earliest inscriptions date back about 5,200 years and were written in a hieroglyphic script.

“Ancient Egyptian was a living oral language, and most hieroglyphs represent the sounds of consonants and certain emphatically expressed vowels,” wrote Barry Kemp, a professor of Egyptology at the University of Cambridge, England, in his book “100 Hieroglyphs: Think Like an Egyptian” (Granta Books, 2005). Kemp noted that the ancient Egyptians also developed “an abbreviated ‘long hand’ form of writing which we call ‘hieratic.'” During the first millennium A.D. this abbreviated hieratic script was supplanted by a new form of short-form writing called “Demotic.”

Egyptian language changed over the millennia, with scholars often subdividing the surviving writings into categories such as “Old Egyptian,” “Middle Egyptian” and “Late Egyptian.”

The Greek language became widely used in the time after Egypt was conquered by Alexander the Great. In the late 19th century, archaeologists excavated half a million papyri fragments, most of which were written in Greek, at the ancient Egyptian town of Oxyrhynchus in southern Egypt, dating to the early centuries A.D.

Coptic, an Egyptian language that uses the Greek alphabet, was widely used after Christianity spread throughout Egypt. As Greek and Coptic grew in popularity, the use of the hieroglyphic writing style declined and became extinct during the fifth century A.D. After A.D. 641 the Arabic language spread in Egypt and is widely used in the country today.

Additional resources

- In this History Channel documentary, you’ll learn how the ancient Egyptians harnessed the power of engineering to build an empire. The video is about 1.5 hours long.

- The Australian Museum put together a timeline of historic and other events in ancient Egypt, including a breakdown of each dynasty and the significant dates within that dynasty.

- This DK book “Ancient Egypt: The Definitive Visual History” could be a fun way to teach kids about the marvels of ancient Egypt.

Source link