Innovative technology company files Chapter 7 bankruptcy, closes

Sometimes technology hype does translate to consumer interest.

For technology products to become affordable, millions of people have to buy them. Early adopters pay higher prices, and if demand then grows, prices come down and more people get in.

Related: Distressed discount furniture chain plans Chapter 11 bankruptcy

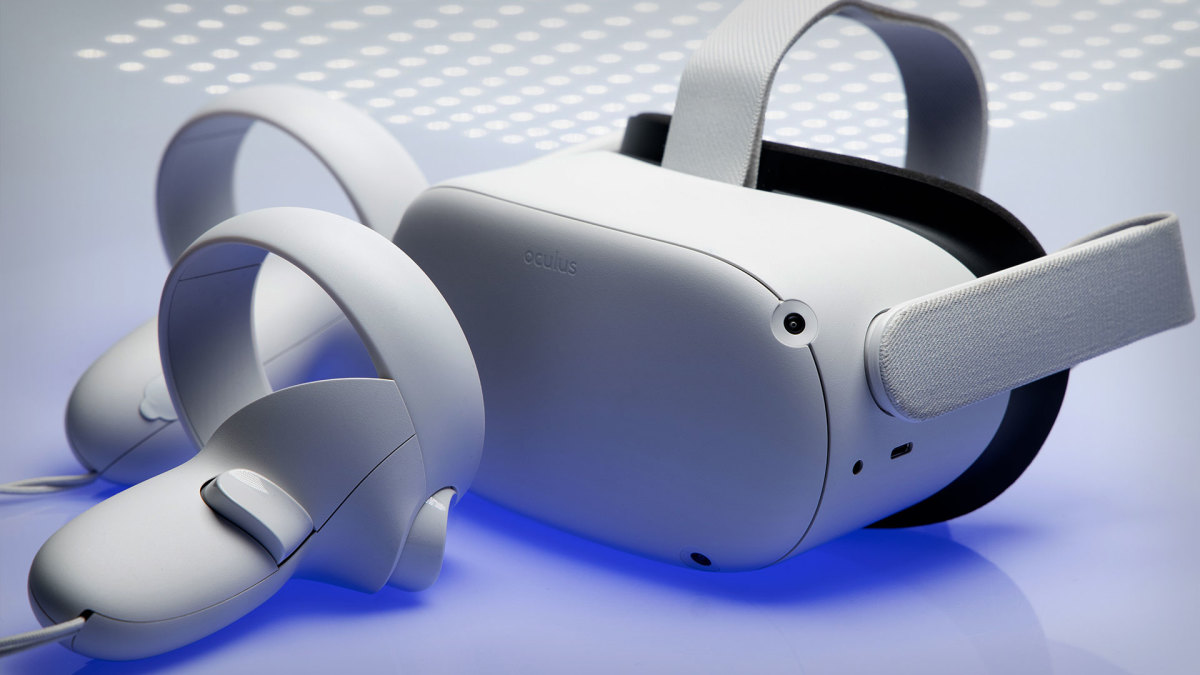

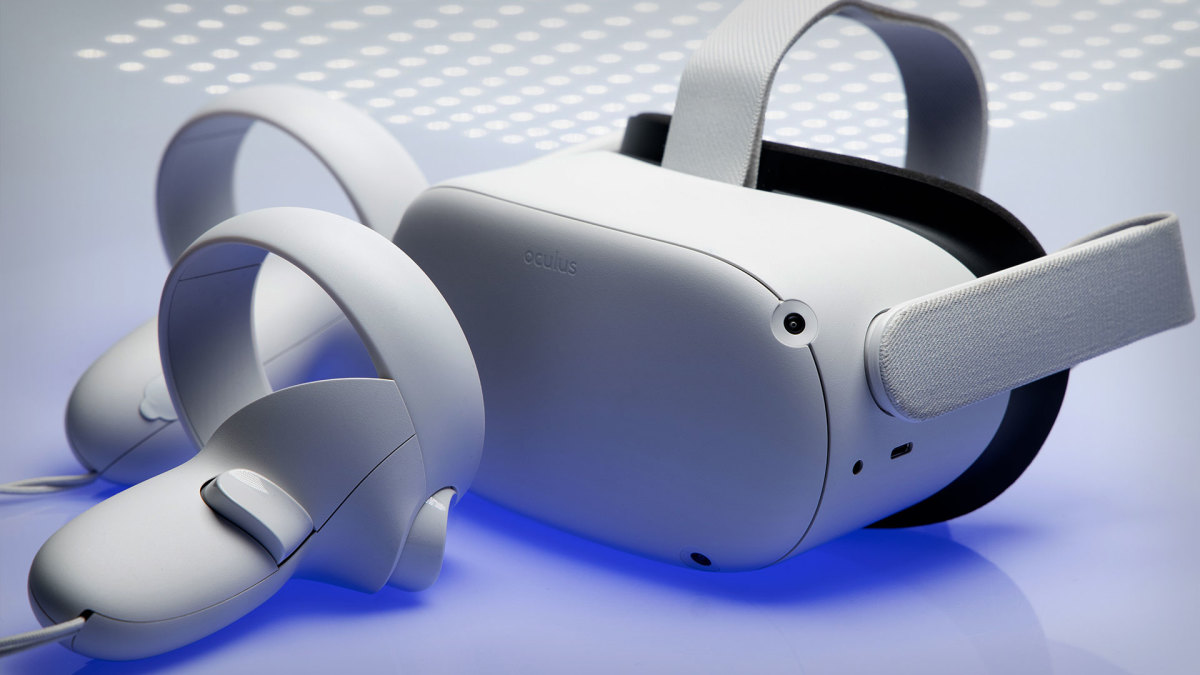

That’s what we’re seeing now with virtual reality wearables. Both Apple and Facebook parent Meta entered that space, but demand has been very limited. Even as VR headsets offer all sorts of uses, from gaming and entertainment to business-related applications, people simply might not want to put them on.

Maybe that will change as the headsets get smaller, but a lack of demand will also slow investment in the category. Plenty of heavily hyped technology never quite translates into mainstream adoption.

Another example: It was only a few years ago that 3D television was supposed to become the Next Big Thing. Multiple television manufacturers showed off 3D TVs and major entertainment players, including Walt Disney, invested in creating programming for the new televisions.

The problem, and it was a big one, is that most people don’t need an immersive experience to watch a basketball game or an episode of “Law & Order.” This visually cool technology did not actually solve a problem or meet a need for consumers, so it died a painful death.

Another 3D technology, 3D printing, hasn’t died, but it hasn’t yet become a mainstream thing, and now one of the most promising players in the space is going to close and will be liquidated.

Be the first to see the best deals on cruises, special sailings, and more. Sign up for the Come Cruise With Me newsletter.

Image source: Shutterstock

3D printing serves a niche market

3D printing, in theory, can solve a lot of problems. It enables, for example, a repair company to print exactly the part a consumer needs to repair. That could keep older models of everything from cars to consumer electronics to heavy-duty manufacturing equipment operating longer.

In addition, 3D printing has some more niche, but still useful, uses. A toy store, for example, might be able to print figurines for collectible miniature games or unique cards for games like Pokemon or Magic: The Gathering (under license of course).

Those smaller uses have not much materialized, but 3D printing has found a niche in manufacturing. Shapeways had been a big player in the space, having served more than one million customers by producing more than 21 million parts using 11 different technologies and 90 different materials and finishes since it was founded in 2007.

“Shapeways’ digital manufacturing platform offers customers access to high-quality manufacturing from start to finish through automation, innovation and digitization,” the company says on its website. “The company’s purpose-built software, a wide selection of materials and technologies, and global supply chain lower manufacturing barriers and speed delivery of quality products.”

Sign up for the Come Cruise With Me newsletter to save money on your next (or your first) cruise.

Shapeways files Chapter 7 bankruptcy

The 3D printing company is one of the pioneers in the space, but it will not survive to see the technology move into the mainstream (or help colonize Mars). Shapeways (SHPW) filed for Chapter 11 bankruptcy protection on July 1, in U.S. Bankruptcy Court for the District of Delaware.

Shapeways has stopped operating and has shut down all its subsidiaries in preparation for its assets to be auctioned off.

“On July 2, 2024, after considering all strategic alternatives, Shapeways Holdings Inc. ceased operations and filed a voluntary petition for relief … under the provisions of Chapter 7 of Title 11 of the United States Code,” according to the filing.

The filing will trigger a default on the company’s “$669,500 secured promissory note dated June 10, 2024, entered into with 3DP Custom Manufacture LLC as lender, which results in acceleration of the company’s obligations under such instruments,” it reported.

More bankruptcy:

- Distressed discount furniture chain plans Chapter 11 bankruptcy

- Struggling housing brand files Chapter 7 bankruptcy, will liquidate

- Popular restaurant chain shares bad Chapter 11 bankruptcy news

In addition, the company’s executive team and board have resigned. As of the filing date, Shapeways no longer has any employees or directors. The sale of its assets and dispersal of any proceeds will be handled by the bankruptcy court.

“As a result of the bankruptcy filing, a Chapter 7 trustee will be appointed by the Bankruptcy Court and will administer the Company’s bankruptcy estate, including liquidating the assets of the Company in accordance with the Bankruptcy Code,” the filing says. “Once a Chapter 7 trustee is appointed, an initial hearing for creditors will be scheduled, and the Notice of Bankruptcy Case Filing will be sent to known creditors.”

The brief Chapter 7 bankruptcy filing did not include a list of creditors or a range of assets and liabilities.

Source link